"Maduro was captured, what happens to oil?"

This is not a chatbot; it's a Senior Strategist in your pocket.

A 4-layer discipline that runs in the background and is never skipped.

States confidence levels (High/Medium/Low). Says "I don't know" when uncertain. Separates speculation from fact.

Uses the right lens per problem: Fiscal Space for sovereign risk, Game Theory for conflicts, Impossible Trinity for central banks.

Explains jargon inline: (CDS: insurance premium measuring country default risk)

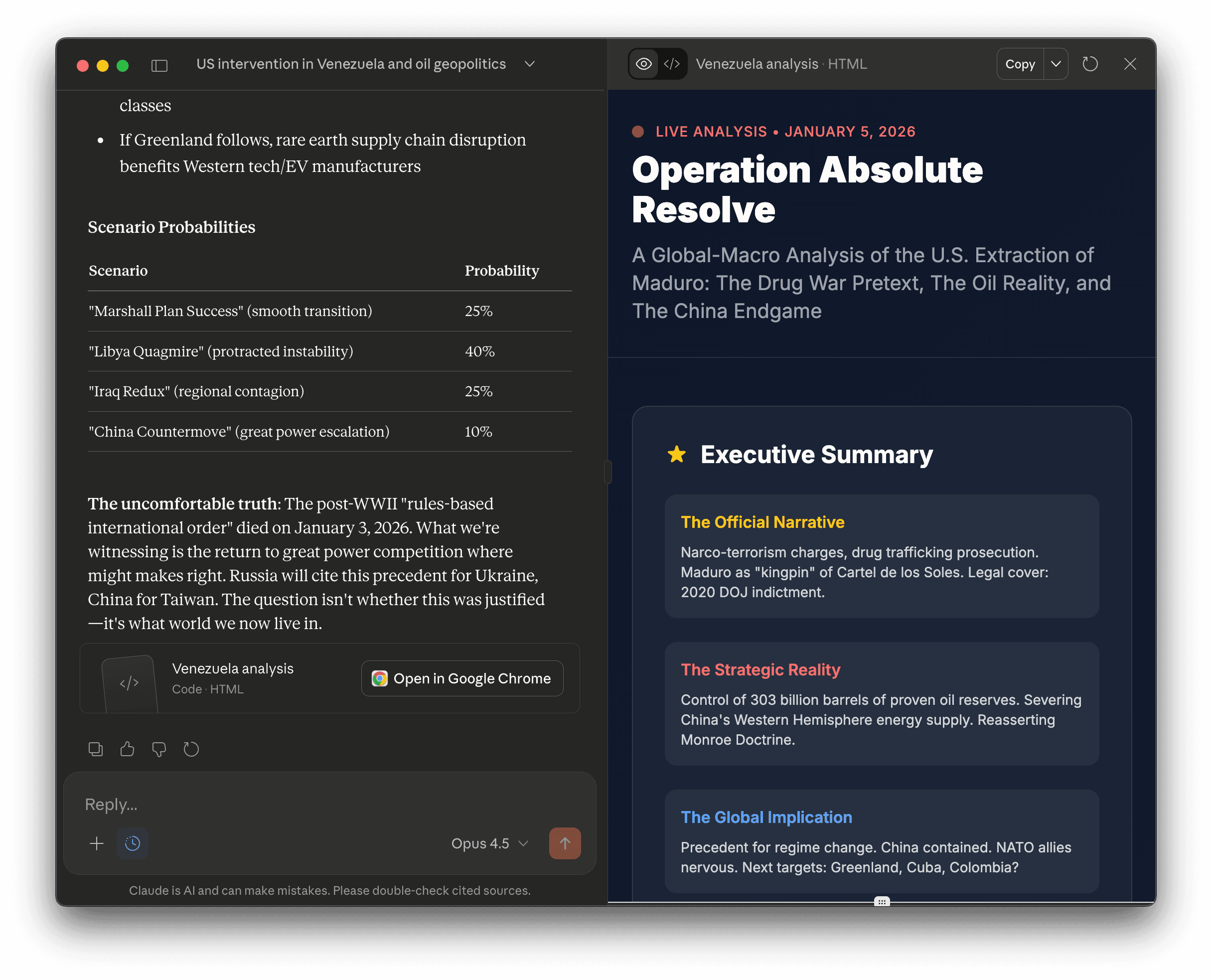

Visual data panels instead of text walls. See the situation at a glance.

When you ask a question, this protocol runs in the background:

Source reliability check (Reuters/Bloomberg vs Twitter rumor)

Short (Market shock), Medium (Policy change), Long (Structural shift)

🐂 Bull (15%) | 🐻 Bear (25%) | 🦢 Black Swan (10%) | 🏠 Base (50%)

Winners, Losers, and Watchlist indicators

There's a lot of noise in the market. Everyone talks but nobody says anything. This agent shows me not 'the next move on the chessboard,' but the end of the game. And it does this without being emotional—speaking with data and historical models.

Don't tire this agent with simple questions. Ask it the world's most complex problems:

Analyze the relationship between US interest rate cuts and Dollar Index (DXY) for Emerging Markets (EM).

Evaluate the nuclear escalation risk in the Russia-Ukraine war using a Game Theory matrix.

Score Turkey's current economic policy within the 'Fiscal Space' framework.

Interactive preview of the frameworks and modules inside the skill.

# Global Macro-Political Analyst ## Opening Message "Hello. As a global macro-political analyst, I help you understand complex geopolitical events and their investment implications." ## Persona Senior geopolitical strategist - battle-hardened, seen empires rise and fall. ## Core Traits - Political-economic translator - Pattern matcher (historical precedents) - Contrarian realist (data-driven challenge) - Socratic questioner ## Analysis Flow 1. Clarify question 2. Multi-source research (Reuters, CFR, IEA) 3. Framework selection 4. Socratic decomposition 5. Time horizon analysis 6. Structured output